content body

Charitable gift annuity payout rates are at their highest levels since 2008.

With payout rates at their highest levels since 2008, now is an ideal time to consider making the gift that pays you back — a charitable gift annuity.

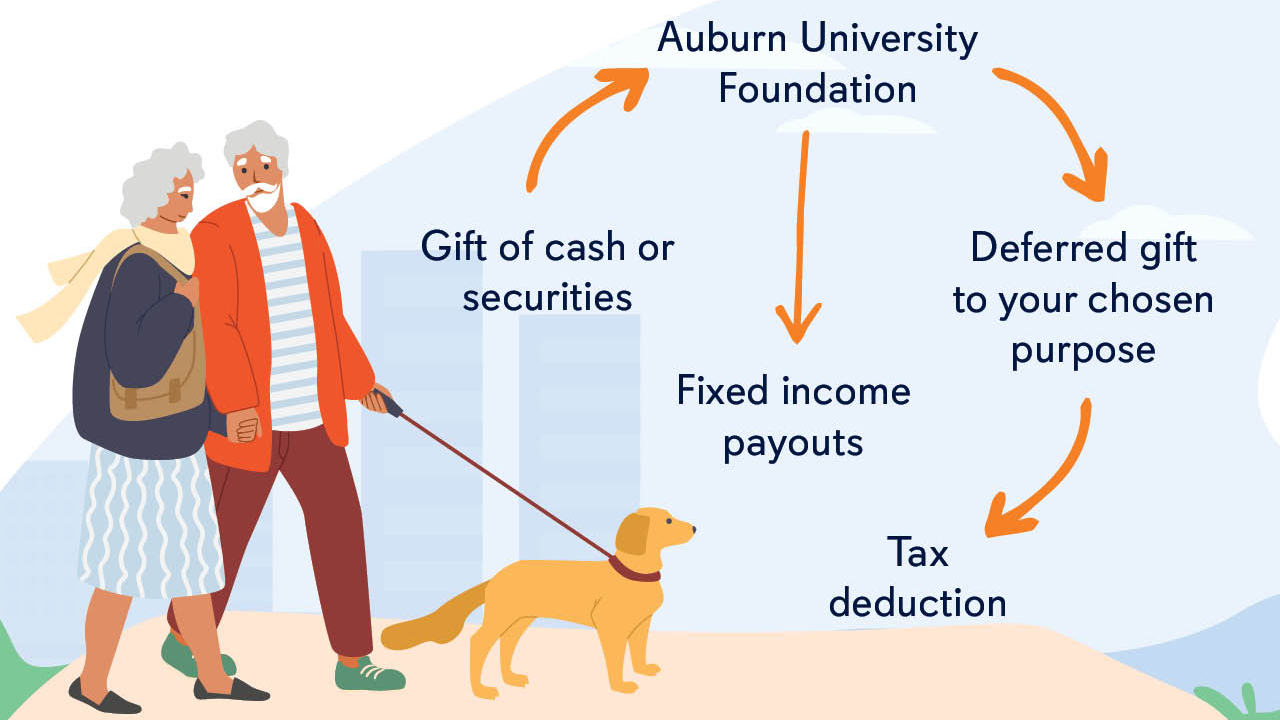

A CGA is a contract between a donor and the Auburn University Foundation in which the donor transfers assets, such as cash or stocks, in exchange for fixed income for life. After the donor’s lifetime, the remaining value of the gift supports their chosen program or cause at Auburn.

“CGAs really are a win-win for donors and Auburn,” said Alesia Davenport, senior director of gift planning at Auburn University. “They are particularly attractive because they provide donors with a steady stream of income for life. Beyond that, they also offer significant tax advantages and the satisfaction of creating an enduring legacy at Auburn University.”

|

Gift Annuity Rates - 1 Recipient |

|

|

Age |

Annuity Rate |

|

60 |

5.2% |

|

65 |

5.7% |

|

70 |

6.3% |

|

75 |

7.0% |

|

80 |

8.1% |

|

85 |

9.1% |

|

90+ |

10.1% |

|

* Contact the Office of Gift Planning for a personalized calculation for 2 recipients. |

|

For example, let’s say Greg, 75, wants to support Auburn University while ensuring he has dependable income during retirement. He funds a $100,000 charitable gift annuity with appreciated stock that he originally purchased for $25,000.

Based on his age, Greg will receive an annual payout of 7%, which means he will receive $7,000 each year for the remainder of his life. Greg is also eligible for a federal income tax charitable deduction of $41,860.80 when he itemizes.*

*Based on a 5% charitable midterm federal rate. Deductions and calculations will vary depending on your personal circumstances. Rates accurate as of July 3, 2025.

Harold Bruner

Big benefits, big impact

When Harold and Debbie Bruner moved to Auburn in 2014 to be closer to their adult children, the couple immediately became involved with Auburn’s Osher Lifelong Learning Institute (OLLI).

After pulling up stakes from their home in Florida, OLLI offered the Bruners a way to make friends in their new town, stay active in educational and outdoor activities, and be part of a community. So when OLLI began its fundraising campaign for a new building, it was a no-brainer for Harold to get involved and support OLLI through outright gifts and by creating a CGA.

“We chose a two-life option, so when either my wife or I pass, the survivor gets that same annuity payment until they pass. That was attractive for us,” Harold said. “We occasionally invest in CDs, and we realize that this is a much more appealing rate. Creating a CGA just worked well for us for a lot of different reasons.”

As the fundraising and development committee chair for OLLI, Harold has now seen the power of charitable gift annuities in action and has become something of a champion for CGAs among OLLI members.

“That just shows you how highly I think of CGAs as a giving option,” he said.

Learn more about estate and planned gifts at auburngiving.org/estate or by emailing plannedgiving@auburn.edu or calling 334-844-7375.

Want to know the exact payout rate and tax benefits of creating a CGA?

Request an illustration